Texas Franchise Tax Assistance

What is Texas Franchise Tax?

Texas imposes a franchise tax on businesses operating within the state. Whether you are a corporation, LLC, partnership, or other entity, compliance with the Texas franchise tax is crucial.

Is Your Business Eligible for No Tax Due Status?

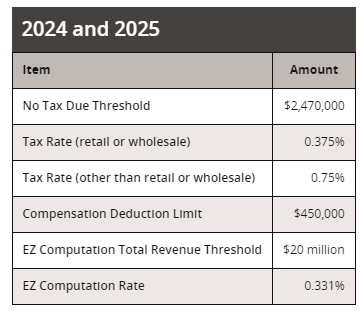

Great news for small businesses! Texas offers a No Tax Due threshold for entities with annualized total revenue less than or equal to $2.47 million. If your gross receipts fall below this limit, you may be exempt from paying franchise tax.

Important Dates to Remember:

- Annual Report Filing Deadline: May 15th

- Franchise Tax Annual Return Due Date: May 15th

Our Services:

- Tax Planning and Compliance: We craft comprehensive tax strategies, ensuring your business not only meets its obligations but also takes advantage of available deductions and credits.

- Financial Analysis: Our experts delve into your financial data to provide accurate reporting and identify opportunities for tax optimization.

- Tax Filing Assistance: Our team of experienced professionals takes care of your annual franchise tax filings. We complete no-tax-due reports as well as calculate correct taxes if your gross receipts are above the threshold.

- Deadline Management: We ensure your business meets all filing deadlines, preventing unnecessary penalties and interest charges.

Why Choose DimovTax?

- Expertise: Our team comprises seasoned CPAs with a deep understanding of Texas tax regulations.

- Personalized Service: Tailored solutions to meet your unique business needs.

- Proactive Guidance: We keep you informed about changes in tax laws and help you plan ahead.

Get Started Today!

Ready to take control of your Texas franchise tax obligations? Contact us below to get started. We are here to support your business success by ensuring tax compliance and optimizing your financial strategy.