Tax Preparation for

Boston & Massachusetts

Our senior tax accountants have been practicing for over a decade and started during the economic downturn of the late 2000s – people told us that if we can grow a business then, then our business model will withstand anything – and they were correct. We’re on the pulse of tax industry trends and have monitored their evolution to inform our own tax approach—all to give you exceptional advice that will last for years to come.

Some of our services offered are below:

Individual Tax Preparation & Strategy

Individual tax planning is our signature specialty and most common engagement in terms of client volume – we are excited to tackle the most simple to most complex individual tax issues, including international reporting, rental properties, equity compensation, multi-state questions, etc.

Regarding tax strategy, we are often hired to assist with estimated/quarterly tax planning, planning related to marriage/new home/new child, strategy regarding new jobs/new state moves, and equity compensation, such as RSU/ISO/NSO. These are just a few of many topics, so reach out below for further assistance.

Corporate Tax Compliance

The world of corporate tax is ever growing and evolving, and we’re not just talking about the 2018 tax changes or business practice changes related to Covid. With the consistent introduction of varying layers of tax, from Federal to State & Local, the complexity grows. That’s where we come in. Our compliance services ensure that your tax returns are filed correctly and on time.

Bookkeeping

We are familiar with all common software platforms for bookkeeping. If your business requires bookkeeping, contact us below for a quote.

Business Strategy

Tax strategy is important both for established companies as well as startups. Our firm gives you a holistic approach to tax planning to ensure you have the correct business structure, deductions, and planning in place for tax optimization.

Due Diligence & Attestation work

Due diligence engagements are for situations where a company is being purchased & the books must be scrutinized to validate the company’s financials ahead of the acquisition. This also includes providing testimony for court cases or forensic accounting engagements. Attestation work includes audits, reviews, and compilations. We are licensed & peer reviewed, as well as registered with the PCAOB.

HR Outsourcing

Demystifying human resource law is in itself a field of its own. It requires regulatory know-how, strategic structuring, individual state compliance laws, and benefits administration. This includes assistance with payroll implementation, benefits, etc. Contact us below for assistance with payroll.

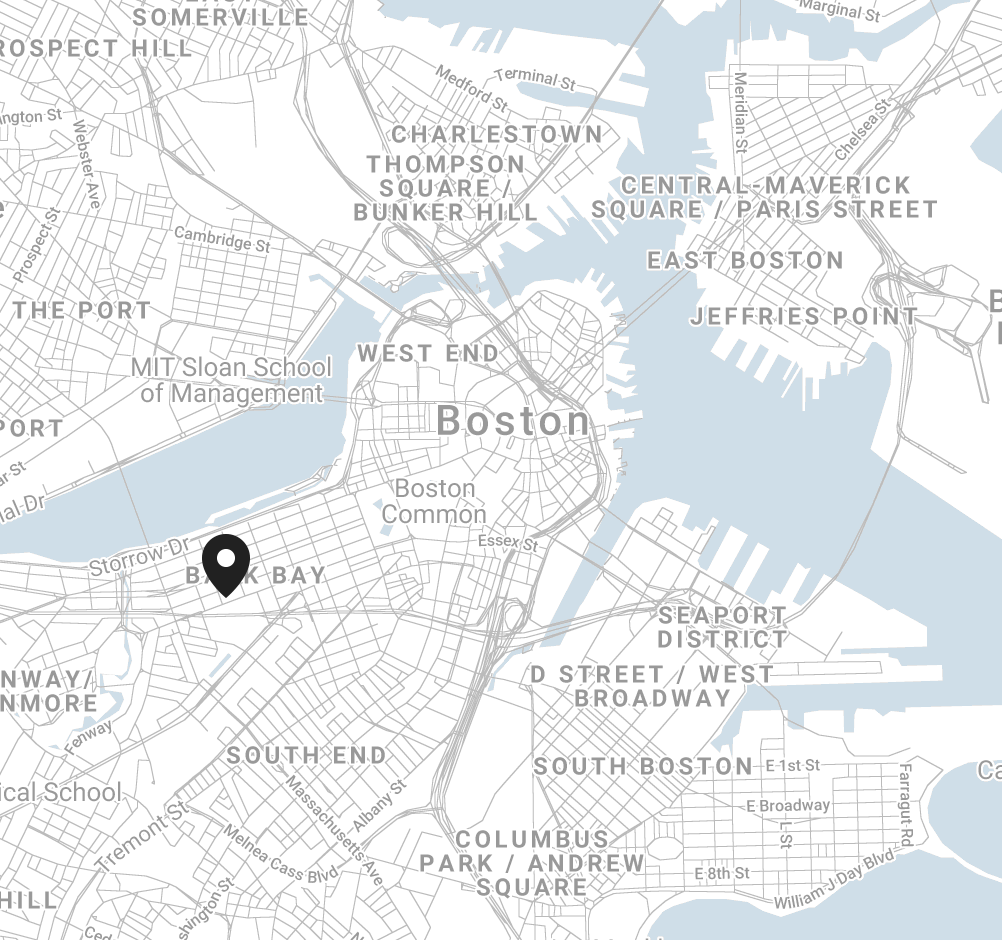

867 Boylston St. Boston, MA 02199

No Walk-ins Please

Call (866) 681-2140 for an Appointment

Please call (866) 681-2140 or fill out the form below for a response usually within 2 hours.