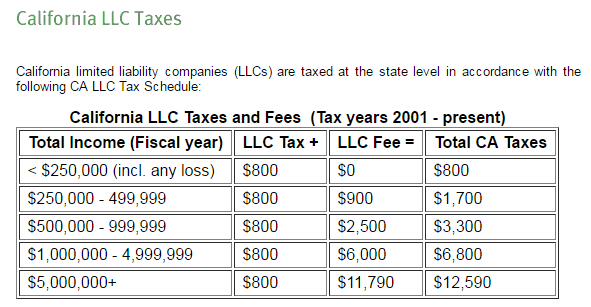

If you have ever registered a business in the State of California as an LLC, you will know that there are annual fees. These fees are $800 per year for just having an LLC in CA (even if you have a loss). Then, you get assessed additional fees based on the amount of sales you make (table below):

However, many persons registering an LLC in CA are not aware that they have a fee that they need to pay each year, even if their business is inactive or even losing money. This may be a surprise. Many owners will declare that they are a Wyoming corporation or Delaware corporation and are not subject to tax. However, if you maintain a facility in CA and otherwise do business there, you will be liable for CA state taxes.

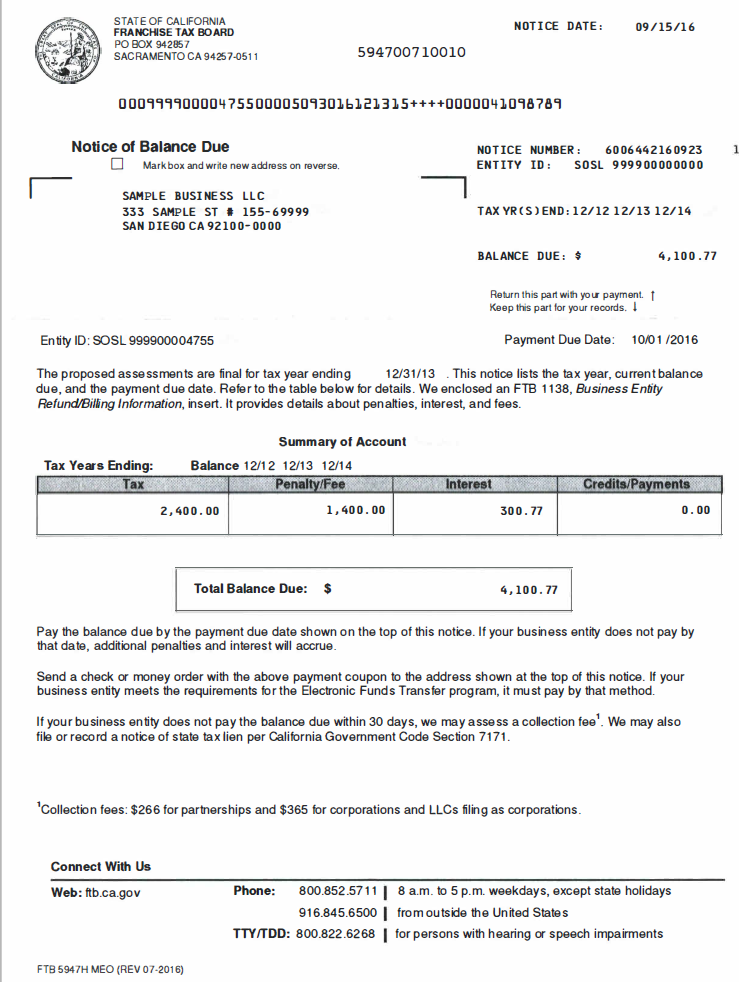

Failure to make these aforementioned payments to the Franchise Tax Board will result in a proposed assessment, like the sample one linked here.

Here is an image:

Sample Notice of Proposed Assessment from the FTB

If you have received a notice like this, possible consequences include:

- Levy on your bank account (example discussed below)

- Liens on property (these will show up on your credit report)

- Suspension of LLC with Secretary of State

- Late charges of interest (see notice above)

- Penalties (see notice above)

What is the solution? The quick answer is to file a California FTB Form 568 for each year that your business was registered in California as an LLC. This applies regardless of whether you are filing on schedule C as a sole proprietor on your federal return. This form is generated by most professional software packages and can also be generated alongside partnership returns.

Below are some actions that I have taken as a licensed CPA and tax practitioner to address clients’ needs when receiving this sort of notice:

- Contacted the practitioner line of the FTB at 916-845-7057 and obtained information regarding these notices. They will notify you that you should be filing form 568 with the state of California for each year.

- In order to discuss taxpayer issues on the phone with the FTB, a power of attorney formis necessary. This can be filed online. Just make a profile with the Franchise Tax Board. They will, however, discuss the return with you on the phone as the CA POA form takes 30 days to process. It can be accessed online and processed entirely online. The client (taxpayer) can login to their account and approve the power of attorney. It is a very efficient process. If the client does not want to login, the CPA can attach a signed PDF of the power of attorney form in the FTB site.

- I strongly recommend to get an understanding and a history of the assessment and notices sent to the taxpayer regarding the notice and any other levies/assessments against the LLC by the Franchise Tax Board. One of the best ways to do this is to send a fax to the correspondence department at the FTB asking for additional details on these two notices (dated 09/30 and 09/20). The fax line is 916-845-9300. These details will come in 90 days or more, but it is worthwhile sending the faxed request for information. Please contact me if you need help writing this request.

- I spoke with the complex situations department at the FTB today (three hour hold time) at 888-635-0494 and obtained the following information:

- You may have a lien going out on your property soon as tax returns are expected to have been filed for each year that sales took place from the CA facility and going to CA clients. One great way to get an idea of how much business was conducted in California is using the Sales Tax Reports filed with the state. Obtain these and use them as your gross sales number for your From 568.

- There is a great way to make sales tax payments online for California. I currently have clients registered with efilesalestax.com

- You need to file a 568 form (LLC income tax return) for sales based on these sales tax reports from CA

- You need to file the returns and ask for the assessments that you received to be reduced, if applicable

- Find out what year the LLC was registered in Cali and CA expects a filing for each year thereafter that has activity

- The process works as follows: You prepare each 568 for each year the LLC was doing business in CA. Then, you send them all in one package to the FTB at the following address:

- State of California

- Franchise Tax Board

- PO Box 942857

- Sacramento, CA 94257-0511

- You should write a check for the total amount due based on the form 568s that you are filing. This amount may differ from the amount that the FTB is claiming on the assessment notice.

- At this point, you can write a “Formal Request for Waiver of Penalties and Interest” which you can include as part of your submission. You should state your case in this letter. Please feel free to contact me if you need assistance with this letter or if you need it on CPA letterhead.

- You will also need the total amount of assets that you have in CA at the end of each year (in total dollar value) for from 568.

- You may have a lien going out on your property soon as tax returns are expected to have been filed for each year that sales took place from the CA facility and going to CA clients. One great way to get an idea of how much business was conducted in California is using the Sales Tax Reports filed with the state. Obtain these and use them as your gross sales number for your From 568.

Here is what I will need from a client in this situation:

- Please send me any other state returns for the years in question from any other state that you do business. If you have not filed such returns, please let me know.

- Please send me total sales specifically arising in CA for each year 2008-2015. Percentage of total federal sales will also work.

- Please send me your CA sales tax reports for each year business was conducted

- Please send me your individual tax returns, if available, for the years in question

Here is the action that I propose:

- Now that we know what the situation is, we must be filing for 568 each year with the FTB to avoid these penalties. This will be based on business you conducted in the state of CA, which I will take from your Sales Tax Reports.

- We need to go back and give the FTB what they want, which is form 568 for each year. Please provide me with the sales tax reports for CA for each year and I will get your form 568s completed and filed with the FTB for a fixed price per year of activity. I can do these for you every year going forward, as well, in order to prevent further levies, possible liens, suspension of LLC with secretary of state, late charges, and penalties.

- Please send me a listing of assets owned at the end of each year in the state of California.

George Dimov, CPA, is registered with the Franchise Tax Board of California as a tax preparer and holds a CPA license that is recognized in all 50 states, as well as a Federal PTIN.

Need some help? Please fill out the form below and one of our specialists will get back to you immediately.

"*" indicates required fields